Pengaruh Struktur Modal dan Pertumbuhan Aset terhadap Nilai Perusahaan dengan Profitabilitas sebagai Variabel Intervening pada Perusahaan Sektor Primer yang Terdaftar di BEI Periode 2019-2023 The Influence of Capital Structure and Asset Growth on Firm Value with Profitability as an Intervening Variable in Primary Sector Companies Listed on the Indonesia Stock Exchange (IDX) for the 2019-2023 Period

Main Article Content

Abstract

This study aims to see how far the influence of capital structure and asset growth has on firm value with profitability as an intervening variable on primer sector consumer non-cyclicals companies listed on the Indonesian stock exchange for the 2019-2023 period. The population in this study are all consumer non-cyclicals companies listed on the Indonesia Stock Exchange in 2019-2023, namely 129 companies. The sample selection technique used purposive sampling and obtained a sample of 32 samples. Methods of data analysis using multiple regression analysis and path analysis in SPSS 26. Based on the hypothesis testing that has been done, it is concluded that the: (1) capital structure have a significant effect on profitability, (2) Asset grwoth has no significant effect on profitability, (3) Capital structure has no significant effect on firm value, (4) Asset grwoth has no significant effect on firm value, (5) Profitability has a significant effect on company value, (6) capital structure has a significant effect on firm value through profitability has an intervening variable, (7) Asset growth has no significant effect on company value through profitability as an intervening variable.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Rahmawati, A. D., & Wibowo, G. (2022). Insider ownership, profitabilitas dan kebijakan dividen. https://ipusnas2.perpusnas.go.id/read-book

Asrulla, A., Risnita, R., Jailani, M. S., & Jeka, F. (2023). Populasi dan Sampling (Kuantitatif), Serta Pemilihan Informan Kunci (Kualitatif) dalam Pendekatan Praktis. Jurnal Pendidikan Tambusai, 7(3), 26320–26332. https://doi.org/10.31004/jptam.v7i3.10836

Astuti, N. K. B., & Yadnya, I. P. (2019). Pengaruh profitabilitas, likuiditas, dan ukuran perusahaan terhadap nilai perusahaan melalui kebijakan dividen. E-Jurnal Manajemen Universitas Udayana, 8(5), 3275. https://doi.org/10.24843/ejmunud.2019.v08.i05.p25

Ayuba, H., Bambale, A. J., Ibrahim, M. A., & Sulaiman, S. A. (2019). Effects of financial performance, capital structure and firm size on firms’ value of insurance companies in Nigeria. Journal of Finance, Accounting and Management, 10(1).

Basdekis, C., Christopoulos, A., Katsampoxakis, I., & Lyras, A. (2020). Profitability and optimal debt ratio of the automobiles and parts sector in the Euro area. Journal of Capital Markets Studies, 4(2), 113–127. https://doi.org/10.1108/JCMS-08-2020-0031

Boenyamin, A. W., & Santioso, L. (2023). The effect of profitability, capital structure, firm size, and asset growth on firm value. International Journal of Application on Economics and Business (IJAEB), 1(3), 1097–1107. https://doi.org/10.24912/ijaeb.v1.i3.1097-1107

Dwiastuti, D. S., & Dillak, V. J. (2019). Pengaruh ukuran perusahaan, kebijakan hutang, dan profitabilitas terhadap nilai perusahaan. Jurnal ASET (Akuntansi Riset), 11(1), 137–146. https://doi.org/10.17509/jaset.v11i1.16841

Hirdinis, M. (2019). Capital structure and firm size on firm value moderated by profitability. International Journal of Economics and Business Administration, 7(1).

Lambey, R. T. J. S. M. (2021). The effect of profitability, firm size, equity ownership, and firm age on firm value (leverage basis). Archives of Business Research, 9(1), 128–139. https://doi.org/10.14738/abr.91.9649

Maptuha, M., Hanifah, A., & Ismawati, I. (2021). Pengaruh struktur modal, likuiditas, dan ukuran perusahaan terhadap nilai perusahaan dengan profitabilitas sebagai variabel intervening. Jurnal Riset Akuntansi Tirtayasa.

Marpaung, N., Yahya, I., & Sadalia, I. (2022). The effect of liquidity, profitability, capital structure, asset growth, and firm size on the firm value with dividend policy as a moderating variable. International Journal of Research and Review, 9(7), 268–282. https://doi.org/10.52403/ijrr.20220731

Latipah, N. S., Hwihanus, & Rahmiyati, N. (2023). Pengaruh likuiditas, struktur aktiva, struktur modal terhadap nilai perusahaan dengan profitabilitas sebagai variabel intervening pada consumer non-cyclical yang terdaftar di Bursa Efek Indonesia. Journal of Trends Economics and Accounting Research, 3(4), 550–560. https://doi.org/10.47065/jtear.v3i4.640

Akhitah, P., & Asyik, N. F. (2019). Pengaruh struktur aset, pertumbuhan aset, dan risiko bisnis terhadap nilai perusahaan dengan struktur modal sebagai variabel intervening. Sekolah Tinggi Ilmu Ekonomi Indonesia (STIESIA) Surabaya.

Putri, T. C., & Puspitasari, R. (2022). Pengaruh struktur modal, keputusan investasi, profitabilitas sebagai variabel intervening terhadap nilai perusahaan. Jurnal Ilmiah Manajemen Kesatuan, 10(2), 255–272. https://doi.org/10.37641/jimkes.v10i2.1437

Sipayung, R. N. (2024). Pengaruh pertumbuhan aset, pertumbuhan penjualan, dan ukuran perusahaan terhadap kinerja perusahaan pada perusahaan otomotif yang terdaftar di Bursa Efek Indonesia. https://repo.stie-pembangunan.ac.id/id/eprint/475/

Trafalgar, J., & Africa, L. A. (2019). The effect of capital structure, institutional ownership, managerial ownership, and profitability on company value in manufacturing companies. The Indonesian Accounting Review, 9(1), 27–38. https://doi.org/10.14414/tiar.v9i1.1619

Sonia, V. (2021). Pengaruh struktur aktiva, likuiditas, pertumbuhan aset terhadap struktur modal dengan profitabilitas sebagai variabel intervening. Repository UPIYPTK. http://repository.upiyptk.ac.id/id/eprint/7370

Widi, E., Widyastuti, T., & Bahri, S. (2021). Pengaruh struktur modal, likuiditas, arus kas bebas, dan ukuran perusahaan terhadap nilai perusahaan dengan profitabilitas sebagai variabel intervening. Jurnal Ekobisman.

Wulandari, C. D., Damayanti, T., & Ekonomi, F. (2022). Pengaruh struktur modal, ukuran perusahaan, dan likuiditas terhadap nilai perusahaan dengan profitabilitas sebagai variabel intervening. Jurnal Ekonomi, 2(1).

Zafirah, P., & Amro, N. (2021). Pengaruh struktur modal, keputusan investasi, profitabilitas sebagai variabel intervening terhadap nilai perusahaan. Jurnal Ilmu dan Riset Akuntansi, 10(7), 1-20. https://jurnalmahasiswa.stiesia.ac.id/index.php/jira/article/view/4099

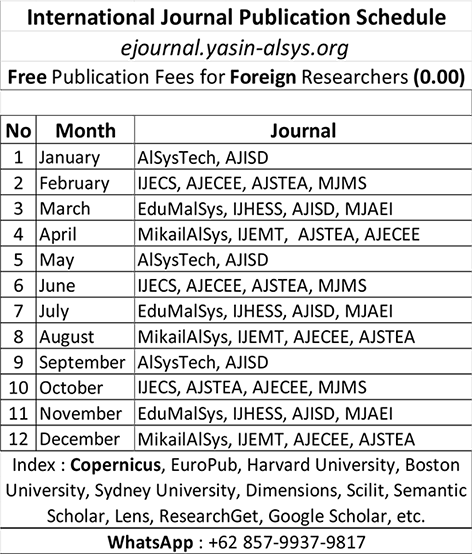

Find the perfect home for your research! If this journal isn't the right fit, don't worry—we offer a wide range of journals covering diverse fields of study. Explore our other journals to discover the ideal platform for your work and maximize its impact. Browse now and take the next step in publishing your research:

| HOME | Yasin | AlSys | Anwarul | Masaliq | Arzusin | Tsaqofah | Ahkam | AlDyas | Mikailalsys | Edumalsys | Alsystech | AJSTEA | AJECEE | AJISD | IJHESS | IJEMT | IJECS | MJMS | MJAEI | AMJSAI | AJBMBR | AJSTM | AJCMPR | AJMSPHR | KIJST | KIJEIT | KIJAHRS |