Collaborative Governance of Rural and Urban Land and Building Tax (PBB-P2) Management in Makassar City

Main Article Content

Abstract

This study aims to analyze the determinants that influence Collaborative Governance of Rural and Urban Land and Building Tax Management (PBB-P2) in Makassar City using the SWOT (Strengths, Weaknesses, Opportunities, and Threats) approach. Existence of collaborative governance PBB-P2 in Makassar City carried out by the Makassar City Regional Revenue Agency (Bapenda) with stakeholders runs more effectively and is able to increase taxpayer compliance in increasing local revenue. One of the success factors of collaboration of a government organization or agency depends on the resources it has and the support of the internal and external environment that affects it. This research uses a qualitative descriptive approach method with data collection through observation, interviews and document review. The results showed that the determinants that influence Collaborative Governance of Rural and Urban Land and Building Tax Management (PBB-P2) in Makassar City are commitment between actors, trust, technological innovation and information systems, and communication. Strategies to utilize strengths to overcome threats to strengthen collaboration through the commitment of the Makassar City Government and the utilization of technology and information systems in the management of PBB-P2 in Makassar City, Strategies to overcome weaknesses and face threats through the placement of human resources of Bapenda Makassar City in accordance with their respective fields of expertise managing taxes and increasing public trust in tax management in Makassar City, Strategies to overcome weaknesses and face threats through collaboration and technological innovation in the management of PBB-P2 in Makassar City and the development of community participation as taxpayers.

Downloads

Article Details

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Ansell, C., & Gash, A. (2008). Collaborative governance in theory and practice. Journal of Public Administration Research and Theory, 18(4), 543–571. https://doi.org/10.1093/jopart/mum032

Ardiansyah, Risnita, & Jailani, M. S. (2023). Teknik Pengumpulan Data Dan Instrumen Penelitian Ilmiah Pendidikan Pada Pendekatan Kualitatif dan Kuantitatif. Jurnal IHSAN : Jurnal Pendidikan Islam, 1(2), 1–9. https://doi.org/10.61104/ihsan.v1i2.57

Arrozaaq, D. L. C. (2016). Collaborative Governance (Studi Tentang Kolaborasi Antar Stakeholders Dalam Pengembangan Kawasan Minapolitan di Kabupaten Sidoarjo). Kebijakan Dan Manajemen Publik, 3, 1–13. http://repository.unair.ac.id/67685/

Budiarso, N., & Napitupulu, L. S. (2015). Pajak Bumi Dan Bangunan Perdesaan Dan Perkotaan (Pbb-P2) Sebagai Pajak Daerah Dan Implikasinya Terhadap Pencatatan Akuntansi Pada Pemerintah Kota Manado. Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 3(1), 463–472.

Dahlia, N. (2023). Upaya Mewujudkan Good Governance Melalui Collaboration Governance Pada Pelayanan Publik. Journal of Governance Innovation, 5(1), 61–79. https://doi.org/10.36636/jogiv.v5i1.2274

Dunggio, T. (2023). Peran Komitmen dan Kompetensi dalam Meningkatkan Kinerja. Jurnal Bisnis Dan Manajemen West Science, 2(02), 102–110. https://doi.org/10.58812/jbmws.v2i02.320

M, N. S. (2019). Strategi Peningkatan Pendapatan Asli Daerah (Pad) Melalui Intensifikasi Dan Ekstensifikasi Penerimaan Pajak Dan Retribusi Daerah Di Kabupaten Enrekang. JAKPP (Jurnal Analisis Kebijakan & Pelayanan Publik), 37–48. https://doi.org/10.31947/jakpp.v1i1.6500

Mukhlasin, A., & Hidayat Pasaribu, M. (2020). Analisis Swot dalam Membuat Keputusan dan Mengambil Kebijakan Yang Tepat. Invention: Journal Research and Education Studies, 1(1), 33–44. https://doi.org/10.51178/invention.v1i1.19

Nasir, M. S. (2019). Analisis Sumber-Sumber Pendapatan Asli Daerah Setelah Satu Dekadeotonomi Daerah. Jurnal Dinamika Ekonomi Pembangunan, 2(1), 30. https://doi.org/10.14710/jdep.2.1.30-45

Nasrulhaq, N. (2020). Nilai Dasar Collaborative Governance Dalam Studi Kebijakan Publik. Kolaborasi : Jurnal Administrasi Publik, 6(3), 395–402. https://doi.org/10.26618/kjap.v6i3.2261

Novalistia, R. L. (2016). Pengaruh Pajak Daerah, Retribusi Daerah, Lain-Lain Pendapatan Asli Daerah yang Sah dan Bagi Hasil Pajak Terhadap Tingkat Kemandirian Keuangan Daerah Pada Pemerintah Kabupaten atau Kota di Provinsi Jawa Tengah (Studi Empiris Pada Kabupaten/Kota Provinsi Ja. Journal Of Accounting, 2(2), 1–25.

Rachdianti, F. T., Astuti, E. S., & Susilo Hery. (2016). Pengaruh Penggunaan E-Tax Terhadap Kepatuhan Wajib Pajak (Studi pada Wajib Pajak Terdaftar di Dinas Pendapatan Daerah Kota Malang). Jurnal Perpajakan (JEJAK), 11(1), 1–7.

Riksfardini, M., Sagara, B., Firmanto, F. S., & Handayani, N. (2023). Inovasi Pelayanan Pajak Berbasis E-Government Melalui Penggunaan E-Filing Dalam Peningkatan Kualitas Pelayanan. Pentahelix, 1(1), 35. https://doi.org/10.24853/penta.1.1.35-44

Sinengkeian, A. A., Rares, J. J., & Rampi, G. B. (2022). Komunikasi Pemerintah Dalam Meningkatkan Kesadaran Masyarakat Membayar Pajak Bumi Dan Bangunan Di Kelurahan Talikuran Kecamatan Kawangkoan Utara Kabupaten Minahasa. Jurnal Administrasi, Vol. VIII(115), 1–9.

Siti Fatimah, A. (2021). Collaborative Governance Dalam Pengembangan Usaha Mikro Di Kota Tasikmalaya. Jurnal Administrasi Dan Kebijakan Publik, 2(3), 124–135.

Soemitro, R. (2017). Pajak Bumi dan Bangunan. Pajak Bumi Dan Bangunan, 37. http://repository.iainbengkulu.ac.id/664/

Wijaya, I. M. A. (2023). Strategi Peningkatan Penerimaan Pajak Daerah Melalui Pembentukan Satuan Tugas Pajak Daerah Oleh Badan Pendapatan Daerah Kabupaten Takalar. Jurnal Pallangga Praja (JPP), 5(2), 117–132. https://doi.org/10.61076/jpp.v5i2.3876

Zulkifli, Kalangi, L., & Hendrik Manosoh. (2016). Analisis Penerimaan Pajak Bumi Dan Bangunan Perdesaan Dan Perkotaan (PBB-P2) Terhadap Kontribusi Pendapatan Asli Daerah (PAD) Di Kota Gorontalo Zulkifli1,. Universitas Sam Ratulangi, 3(September), 171–179.

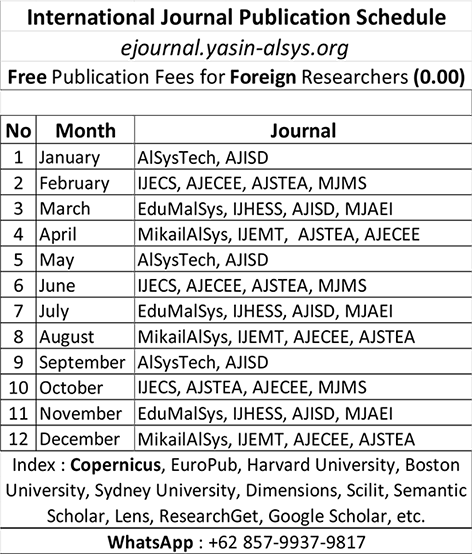

Find the perfect home for your research! If this journal isn't the right fit, don't worry—we offer a wide range of journals covering diverse fields of study. Explore our other journals to discover the ideal platform for your work and maximize its impact. Browse now and take the next step in publishing your research:

| HOME | Yasin | AlSys | Anwarul | Masaliq | Arzusin | Tsaqofah | Ahkam | AlDyas | Mikailalsys | Edumalsys | Alsystech | AJSTEA | AJECEE | AJISD | IJHESS | IJEMT | IJECS | MJMS | MJAEI | AMJSAI | AJBMBR | AJSTM | AJCMPR | AJMSPHR | KIJST | KIJEIT | KIJAHRS |