The Effect of Solvency, Profitability, Growth, and Firm Size on Firm Value in Indonesia’s Oil and Gas Subsector (2019–2023)

Main Article Content

Abstract

This study addresses the limited research on financial determinants of firm value in Indonesia’s oil and gas subsector, a strategic industry for both energy security and capital market performance. It examines the effects of solvency, profitability, firm growth, and firm size on firm value during 2019–2023. Using a quantitative approach, secondary data from 13 listed companies were selected through purposive sampling, sourced from audited annual reports, and analyzed using panel regression with the Random Effect Model. The findings reveal that profitability (ROA) has a significant positive effect on firm value (PBV), whereas solvency (DER), firm size (LN.TA), and firm growth have no significant effects. These results suggest that in a capital-intensive, commodity-driven sector, operational efficiency is a stronger driver of market valuation than scale or leverage. Managerially, oil and gas companies should prioritize improving ROA through cost efficiency, asset optimization, and stable production rather than focusing solely on asset expansion. For investors, profitability emerges as a more reliable valuation indicator than firm size or debt structure. For regulators and the Indonesia Stock Exchange, sector-specific disclosures emphasizing operational efficiency and production performance could enhance market transparency. Future studies are encouraged to incorporate macroeconomic variables, global oil price movements, and non-financial performance metrics to provide a more comprehensive understanding of firm value in the energy sector.

Downloads

Article Details

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Andriani, W., Ananto, R. P., Fitri, W. N., & Aprila, D. (2023). Corporate Policy Strategy Based on Comparison of Financial Performance Due to the Impact of the Covid-19 Pandemic. Ilomata International Journal of Tax & Accounting, 4(1), 70–91. https://doi.org/10.52728/ijtc.v4i1.662

Andriani, W., Ananto, R. P., Rosalina, E., Fitri, W. N., & Aprila, D. (2022). Pandemi Covid-19 dan Dampaknya Terhadap Perubahan Kebijakan Perusahaan Sektor Teknologi. Journal of Applied Accounting and Taxation, 7(2), 54–61. https://doi.org/10.30871/jaat.v7i2.4701

Aprila, D., Andriani, W., & Ananto, R. P. (2023). Financial Management of Nagari Owned Enterprises (BUMNAG) and Its Impact on Community Welfare. Jurnal Akuntansi Bisnis, 16(2), 210–225. https://doi.org/10.30813/jab.v16i2.4461

Armana, I. M. R., & Purbawangsa, I. B. A. (2021). the Effect of Profitability, Firm Size, Capital Structure and Tax Avoidance on Firm Value. Russian Journal of Agricultural and Socio-Economic Sciences, 119(11), 31–40. https://doi.org/10.18551/rjoas.2021-11.04

Cahyani, N. K. S. I., Pradnyani, N. L. P. S. P., & Artaningrum, R. G. (2023). The Effect of Profitability, Liquidity, and Company Size on Company Value in The Banking Subsector. International Journal of Pertapsi, 1(1), 32–40. https://doi.org/10.9744/ijp.1.1.32-40

Fitri, W. N., Andriani, W., & Ananto, R. P. (2023). Financial Performance of Infrastructure Companies Before and During the Covid-19. Jurnal Manajemen Universitas Bung Hatta, 18(1), 114–123. https://doi.org/10.37301/jmubh.v18i1.22064

Ghozali, I. (2014). Structural Equation Modeling; Metode Alternatif Dengan Partial Least Square (PLS) (4th ed.). Badan Penerbit Universitas Diponegoro.

Handini, E. D., & Susilo, D. E. (2025). Analyzing Profitability, Firm Size, and Capital Structure’s Impact on Firm Value. Journal of Accounting Science, 9(1), 114–131. https://doi.org/10.21070/jas.v9i1.1953

Jihadi, M., Vilantika, E., Hashemi, S. M., Arifin, Z., Bachtiar, Y., & Sholichah, F. (2021). The Effect of Liquidity, Leverage, and Profitability on Firm Value: Empirical Evidence from Indonesia. Journal of Asian Finance, Economics and Business, 8(3), 423–431. https://doi.org/10.13106/jafeb.2021.vol8.no3.0423

Mansikkamäki, S. (2023). Firm growth and profitability: The role of age and size in shifts between growth–profitability configurations. Journal of Business Venturing Insights, 19, e00372. https://doi.org/https://doi.org/10.1016/j.jbvi.2023.e00372

Meiryani, M., Olivia, O., Sudrajat, J., & Daud, Z. M. (2020). The Effect Of Intellectual Capital On Corporate Performance. International Journal of Advanced Computer Science and Applications (IJACSA), 11(5), 272–277. https://doi.org/10.0484/IJACSA.10384.v1.04

Murti, G. T., & Azizah, C. Y. N. (2024). The Influence of Profitability, Liquidity, and Firm Size on Firm Value. JHSS (Journal of Humanities and Social Studies), 08(1), 132–137. https://doi.org/10.33751/jhss.v8i1.8735

Oktasari, D. P., Widyanti, W., & Lestari, R. (2025). The Influence of Liquidity, Solvency, Profitability, and Company Size on Firm Value. International Journal of Management Studies and Social Science Research, 07(01), 196–205. https://doi.org/10.56293/ijmsssr.2025.5421

Pangaribuan, L., Ismail, T., Taqi, M., & Yazid, H. (2022). Profitability, Liquidity, and Solvency’s Impact on Company Value: The Quality Audit’s Moderating Role. ICOSTELM, 4(5), 1–11. https://doi.org/10.4108/eai.4-11-2022.2328939

Pradika, A., & Dwiati, A. R. (2021). The Influence of Profitability, Capital Structure, Liquidity and Firm Size on Firm Value. International Journal of Business and Management Invention (IJBMI) ISSN, 10(7), 32–38. https://doi.org/10.35629/8028-1007033238

Radja, F. L., & Artini, L. G. S. (2020). The Effect Of Firm Size, Profitability and Leverage on Firm Value. International Journal of Economics and Management Studies, 7(11), 18–24. https://doi.org/10.14445/23939125/IJEMS-V7I11P103

Reschiwati, R., Syahdina, A., & Handayani, S. (2020). Effect of liquidity, profitability, and size of companies on firm value. Utopia y Praxis Latinoamericana, 25(Extra 6), 325–332. https://doi.org/10.5281/zenodo.3987632

Safitri, A. Z., Andriani, W., & Herman, L. A. (2023). Financial Statement Integrity : What Are Things That Influence It? Jurnal Ilmiah Raflesia Akuntansi, 9(1), 22–31. https://doi.org/10.53494/jira.v9i1.198

Sugiyono. (2024). Metode Penelitian Kuantitati, Kualitatif dan R&D. Bandung: Alfabeta.

Yadav, I. S., Pahi, D., & Gangakhedkar, R. (2022). The nexus between firm size, growth and profitability: new panel data evidence from Asia–Pacific markets. European Journal of Management and Business Economics, 31(1), 115–140. https://doi.org/10.1108/EJMBE-03-2021-0077

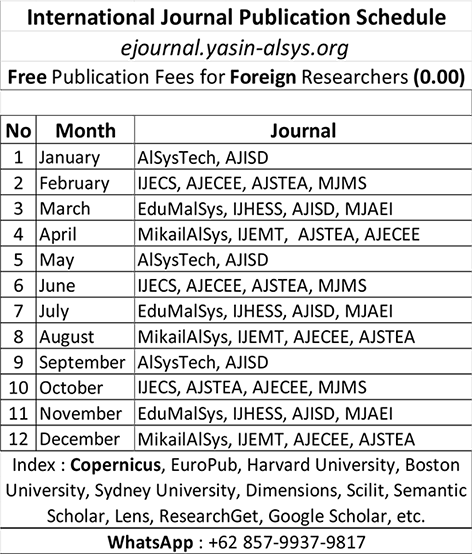

Find the perfect home for your research! If this journal isn't the right fit, don't worry—we offer a wide range of journals covering diverse fields of study. Explore our other journals to discover the ideal platform for your work and maximize its impact. Browse now and take the next step in publishing your research:

| HOME | Yasin | AlSys | Anwarul | Masaliq | Arzusin | Tsaqofah | Ahkam | AlDyas | Mikailalsys | Edumalsys | Alsystech | AJSTEA | AJECEE | AJISD | IJHESS | IJEMT | IJECS | MJMS | MJAEI | AMJSAI | AJBMBR | AJSTM | AJCMPR | AJMSPHR | KIJST | KIJEIT | KIJAHRS |