A Combination of ARIMA Models and Neural Networks in Forecasting Nigerian Exchange Rate

Digital Object Identifier:

10.58578/amjsai.v1i1.3367

Digital Object Identifier:

10.58578/amjsai.v1i1.3367

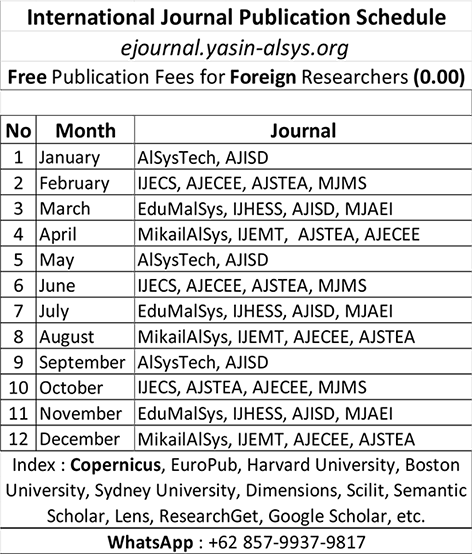

Please do not hesitate to contact us if you would like to obtain more information about the submission process or if you have further questions.

Abstract

Over the years, the United States Dollar, European Euro, and the British Pound Sterling exchange rate to Nigerian Naira has been on the increase. It has become pertinent to identify robust models that will help to cope with the variability associated with the increase in exchange rate. Several studies showed the ARIMA method to be highly useful in modelling and forecasting exchange rates. However, not much work has been done on modelling and forecasting Nigerian Exchange rate using machine learning models which is the focus for this study. The models we used in the study are; the Autoregressive Integrated Moving Average (ARIMA), Artificial Neural Network (ANN), and ARIMA-ANN models. Secondary data obtained from Central Bank of Nigeria (CBN) were used. The results showed that the most appropriate model out of the three time series models considered for these exchange rates is the ARIMA-ANN which produced a better forecast compared to ARIMA and ANN. This conclusion was based on the lowest standards of prediction accuracy which ARIMA-ANN produced the lowest Mean Absolute Error (MAE), Root Mean Square Error (RMSE), and Mean Absolute Percentage Error (MAPE) values for the three different currencies we compared against the naira. Based on the continuous increase in the Nigerian Exchange Rate, the Government and policymakers should take economic measures to avoid the persistent downfall of the Nigerian Naira.

Citation Metrics:

Downloads

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Models. International Journal of Recent Research in Commerce Economics and

Management (IJRRCEM), Vol. 2, www.paperpublications.org.

Guobadia E. K. and Ibeakuzi P. O. (2021). Short Term Modeling of the Nigerian Naira/United

States Dollar Exchange Rate Using ARIMA Model. Sch J Phys Math Stat, 2021 Jan 8(1):

8-13.

Katerina, Z. (2023). Exchange Rate Forecasting with Artificial Intelligence, Mediterranean

University of Albania, Department of Information Technology, Tirana, Albania. Smart Cities and Regional Development Journal (V7. I1.2023).

Roneda, M. and Valentina, S. (2017). Exchange Rate Forecasting using ARIMA, NAR, and

ARIMA-ANN Hybrid Model. Journal of Multidisciplinary Engineering Science and

Technology (JMEST), ISSN: 2458-9403, Vol. 4, Issue 10.

Suleiman, S., and Burodo, M. S. (2018). Comparative Studies of ARIMA and Artificial Neural

Network in Forecasting Naira/Dollars Exchange Rate. UMYUK Journal of Economics

and Development (UJED), Vol. 1 No. 3,

https://www.researchgate.net/publication/357835987.

Yohana, V. M., and Olubusoye, O. E. (2014). Foreign Exchange Prediction: A Comparative

Analysis of Foreign Exchange Neural Network (FOREXNN) and ARIMA Models.

https://www.researchgate.net/publication/280040546.