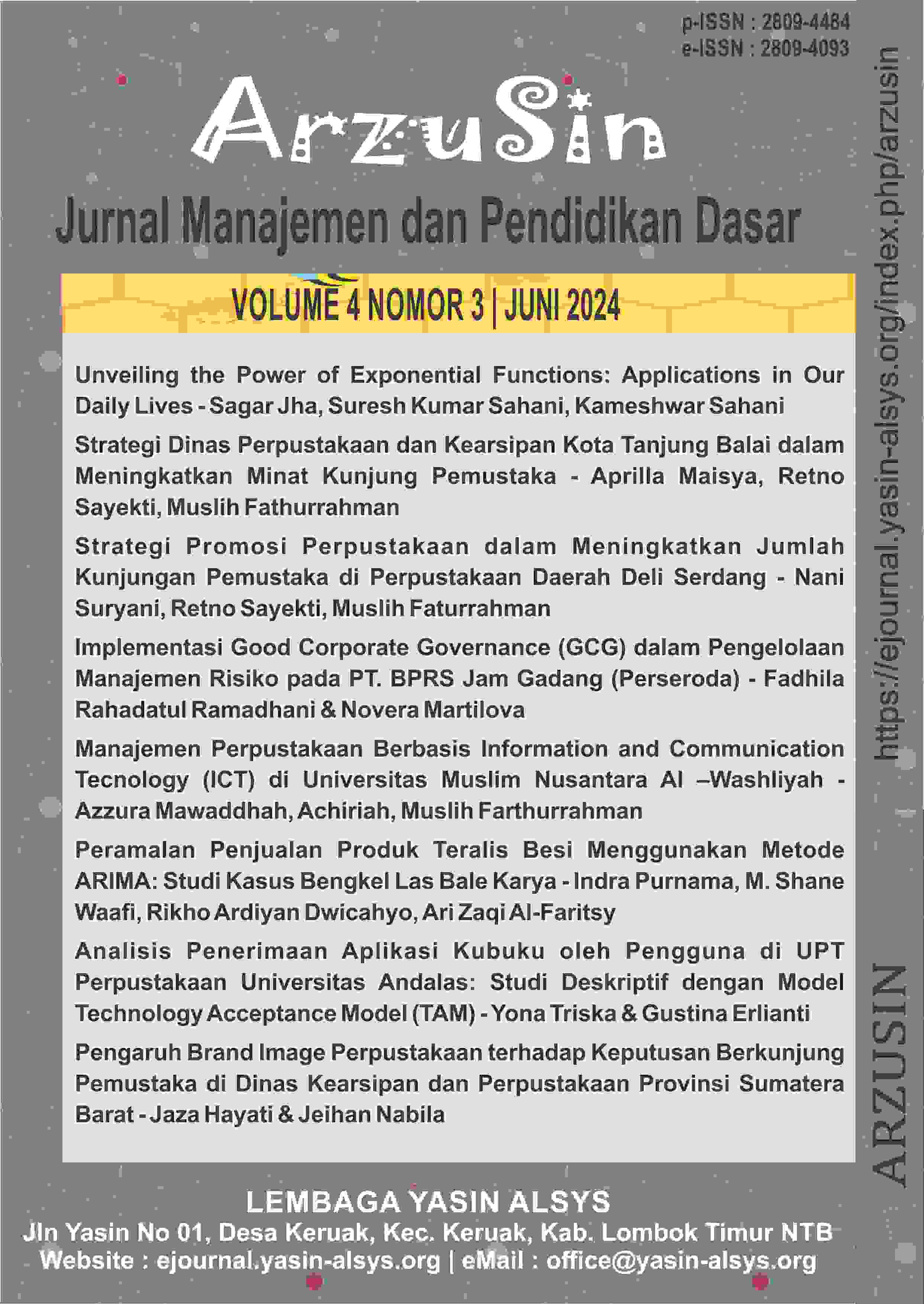

Implementasi Good Corporate Governance (GCG) dalam Pengelolaan Manajemen Risiko pada PT. BPRS Jam Gadang (Perseroda) The Implementation of Good Corporate Governance (GCG) in Risk Management at PT. BPRS Jam Gadang (PERSERODA)

Main Article Content

Abstract

This research is motivated by the occurrence of fluctuations in the increase in the number of customers and the increase in the number of problematic financing customers of PT. BPRS Jam Gadang Perseroda, because the number of problematic financing customers is closely related to the implementation of good corporate governance (GCG) in risk management. This study aims to determine how the Implementation of Good Corporate Governance (GCG) in Risk Management at PT. BPRS Jam Gadang (PERSERODA). The research that the author did was with a qualitative approach method, the data sources that the author took were from primary data and secondary data. And data collection techniques with observation, interviews, and documentation. While the data analysis technique obtained using data analysis, namely data reduction, data display, conclusions and verification. Based on the results of research and analysis that the authors conducted, it can be concluded that the Implementation of Good Corporate Governance (GCG) in Risk Management at PT BPRS Jam Gadang (PERSERODA) shows that the company has run it well, adhering to principles such as transparency, accountability, responsibility, openness, and independence. The bank develops risk management strategies to effectively manage its activities and maintain good operational performance. And there are two obstacles faced, namely laws and regulations made by the bank, and the quality of human resource investment.

Citation Metrics:

Downloads

Article Details

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Buchori Alma dan Donni Juni Priansa. (2014). Manajemen Bisnis Syariah. Bandung: Alfabeta.

Ferry N. Idroes. (2008). Manajemen Risiko Perbankan, Pemahaman Pendekatan 3 Pilar Kesepakatan Basel II Terkait Aplikasi Regulasi dan Pelaksanaannya di Indonesia. Jakarta : PT Raja Grafindo Persada.

Idroes, Ferry N dan Sugiarto. (2006). Manajemen Risiko Perbankan Dalam Konteks Kesepakatan Basel dan Peraturan Bank Indonesia, (Yogyakarta: Graha Ilmu

Khotibul Umam, S.H.,LL.M. (2009). Trend pembentukan Bank Umum Syari’ah Pasca Undang- Undang Nomor 21 Tahun 2008 (Konsep, Regulasi, dan Implementasi). Yogyakarta : BPFE Yogayakrta

Muhammad. (2014). Manajemen Keuangan Syariah, Muhamad, Manajemen Keuangan Syariah Analisis Fiqh dan Keuangan. Yogyakarta: UPP STIM YKPN

Nurul Huda, Mustafa Edwin Nasution. (2014). Current Issues Lembaga Keuangan Syariah, (Jakarta: Kencana

Peraturan Bank Indonesia Nomor 11/33/PBI/2009 tentang Pelaksanaan Good Corporate Governance (GCG) bagi Bank Umum Syariah dan Unit Usaha Syariah.

Rachmadi Usman. (2014). Aspek Hukum Perbankan Syariah di Indonesia. Jakarta: Sinar Grafika