Comparison of Value at Risk (VaR) in Risk Analysis: Historical, Variance Covariance and Monte Carlo Methods

Digital Object Identifier:

10.58578/mjms.v2i3.3778

Digital Object Identifier:

10.58578/mjms.v2i3.3778

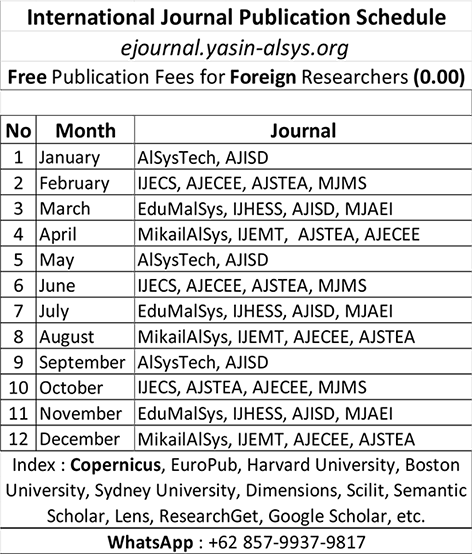

Please do not hesitate to contact us if you would like to obtain more information about the submission process or if you have further questions.

Abstract

Value at Risk (VaR) is a method used to measure financial risk in a company. VaR calculations are often used to calculate the level of loss from shares in a company, such as bank shares. The aim of this research is to determine the level of losses in Bank Central Asia shares using the historical method, the Variance-covariance method, and the Monte Carlo method. the results showed that with an initial investment of $50 and using the Historical method at a significant level of 95%, the VaR value was obtained at $16.42 or IDR. 267.301 and at the 90% significant level, the VaR value was obtained at $12.41 or IDR. 202.022. Based on the Variance-covariance method with an initial investment of 50$ at the 95% significant level, the VaR value is obtained at $16.42 or IDR. 267,301 and at the 90% significant level, the VaR value is obtained at $12.79 or IDR. 208.208. Meanwhile, based on the Monte Carlo method with an initial investment of $50, at a significant level of 95%, the VaR value is obtained at $16.46 or IDR. 267,952 and at the 90% significance level, the VaR value is obtained at $12.84 or IDR. 209.022. Based on the three methods used, it was concluded that the Monte Carlo method gave greater results compared to the other two methods.

Citation Metrics:

Downloads

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

References

Amin, Farah Azaliney Mohd, Siti Fatimah Yahya, Siti Ainazatul Shazlin Ibrahim, and Mohammad Shafiq Mohammad Kamari. (2018). Portfolio Risk Measurement Based on Value at Risk (VaR). in AIP Conference Proceedings (American Institute of Physics Inc.), MCMLXXIV. https://doi.org/10.1063/1.5041543.

Chong, Y. Y. (2004). Investment risk management. John Wiley & Sons. https://books.google.co.id/books?hl=id&lr=&id=qswR5snaEjwC&oi=fnd&pg=PR5&dq=investment+risk+sources&ots=blMhGxPb3I&sig=MyW5_xYRGVbSVI-PwNr4cbL8_I&redir_esc=y#v=onepage&q=investment%20risk%20sources&f=false

Danielsson, J. (2011). Financial risk forecasting: the theory and practice of forecasting market risk with implementation in R and Matlab. John Wiley & Sons.

Elga Fitaloka, Evy Sulistianingih , Hendra Perdana. (2018). Pengukuran Value Atrisk (Var) Pada Portofolio Dengan Simulasi Monte Carlo. Buletin Ilmiah Math. Stat. dan Terapannya (Bimaster), 7 (2), 141-148. https://dx.doi.org/10.26418/bbimst.v7i2.25055.

Günay, Samet. (2017). Value at Risk (VaR) Analysis for Fat Tails and Long Memory in Returns. Eurasian Economic Review, 7 (2), 215–30. https://doi.org/10.1007/s40822-017-0067-z.

Machfiroh, I. S,. (2016). Pengukuran Risiko Portofolio Investasi dengan Value at RISK (VaR) melalui Pendekatan Metode Variansi-Kovariansi dan Simulasi Historis. Jurnal Sains % Informatika, 2 (2). https://adoc.pub/pengukuran-risiko-portofolio-investasi-dengan-value-at-risk-.html.

Maruddani dan Purbowati. (2009). Pengukuran Value at Risk pada Aset Tunggal dan Portofolio dengan Menggunakan Simulasi Monte Carlo (Studi Kasus PT. Telekomunikasi dan PT. Astra International). Media Statistika, II (2). https://stei.ac.id/ojsstei/index.php/AkuntansiSTEI/article/view/750.

Maronrong, R., Hermastuti, P., & Muntahak, S. (2022). Analisis Value at Risk untuk Keputusan Investasi Menggunakan Simulasi Historis. Jurnal Akuntansi STEI, 5(2), 21 - 30. Retrieved from https://stei.ac.id/ojsstei/index.php/AkuntansiSTEI/article/view/750.

Rosadi, D. (2012). Diktat Manajemen Risiko Kuantitatif, Universitas Gadjah Mada Yogyakarta. https://vdocuments.mx/manajemen-resiko-kuantitatif.html.

Triani, L. F. (2013). Faktor-Faktor Yang Mempengaruhi Perubahan Indeks Harga Saham Di Jakarta Islamic Index Selama Tahun 2011. Jurnal Organisasi dan Manajemen, 9(2), 162-178.